Top 10 Issues with Manual Cash Allocation

What is Cash Allocation? What does Cash Allocation mean?

Why is Cash Allocation important?

It’s imperative that as payments are received that they are applied to the correct customer and against the specific invoice transaction they relate to. Cash allocation needs to be conducted promptly in order to understand which customers and invoices are paid and which are outstanding. Without doing this it can be almost impossible to track and action overdue payments.

A manual cash allocation process will typically mean there is as much, or more, focus in the accounts receivable teams on cash allocation as debt chasing. The unintended consequence of this can be delayed collections and payments which can put an organisation at the edge of a cashflow cliff, but there are other significant challenges that arise from a manual process.

- Customer Experience

Manual cash allocation processes can often suffer delays. This results in customers being chased for invoices that they may have already paid, meaning that credit controllers time and effort is being expended on activities which are not producing any value and probably only serves to annoy customers. This clearly doesn’t send a message suggesting a high degree of organisational competence. Worse still, if the non-existent ‘bad- debt’ is flagged for escalated collections processes or means that a customer account is put on ‘stop’ or ‘stop ship.’ - Employee Experience

With periods of the working day being spent chasing customers unnecessarily and repetitive manual tasks attempting to allocate cash, this can lead to poor employee experience and engagement. There can be nothing more sole destroying for an ambitious, bright employee than having to carry out repetitive, monotonous tasks. According to a study by the University of Oxford, happy workers are 13% more productive, so organisations are also losing out on potential productivity gains by not giving teams the best tools to perform their roles and risking poor employee satisfaction. - Keeping Pace with Other Business Areas

Whist other areas of the organisation are benefiting from new technology and the latest software platforms, accounts receivables functions may often feel left behind. Particularly where organisations have a strong sales-based focus, which lends itself to investments to assist the sales teams in terms of prospecting tools, CRM systems and add-ons as well as associated marketing activities, it can feel that all efforts are made to obtain orders, but little or no support to assist in collection. - Peak Period Resources

Peak periods for allocating cash may be as a result of increased transaction volumes or in line with an organisation’s financial period end (month end, year end etc). This additional pressure can mean having to extract resources from other teams to enable to the process to be completed. Whilst this can help to ensure cash is allocated, it will start to impact other parts of the organisation such as chasing and resolving bad debt. - Faster Payments Service

The premise behind FPS was to reduce payment times between bank accounts. However, this doesn’t necessarily help with the cash allocation process where remittances are not received at the same time. If anything, it can make the process of matching more difficult due to the increase in the number of transactions to match against. - Specialist Knowledge

In a manual processing environment, it is not uncommon that individual members of the cash allocation team hold information in their heads about how certain customers pay and are able to decipher particular transaction methods, payment references and banking details. This causes organisations a challenge when these individuals take the decision to move on, have leave or change their role. - Limited Organisational Capacity

Organisations are continually assessing how they can increase their capability to deliver services and products that not only satisfy customers but also provide them with the agility and flexibility to cope with future demand. The capacity of a manual process is directly proportional to how many people are available to perform it, so the only way to increase capacity is to add additional resources. For organisations aiming to increase delivery capability, automation is an enabler to break the link between resources and capacity. - Misallocation

Where teams are under pressure and conducting manual activities the chances of error start to increase and may result in the misallocation of transactions. This has a compound negative effect in that it then makes subsequent matching activities more challenging and leads to additional time to un-pick the error. - Alias Names or Single Payment for Multiple Invoices

It’s not uncommon that some organisations will have a different name on the their bank account to the name held in the accounts system. This can make matching more challenging and it is often heuristic knowledge held in the heads of the account receivable team about specific customers that allows the transaction to allocated. In many cases, customers will settle multiple invoices or part of an invoice in a single transaction which makes matching harder as it is no longer a 1:1 correspondence between invoice and payment. - Cashflow

Ultimately, a manual process can lead to cash being trapped on a balance sheet which could be better utilised by an organisation. Neatly summarised by Deloitte, ‘Strategies for optimizing your accounts receivable’

“Given the cost of new capital, no business can afford to let their existing capital go to waste. However, some businesses don’t realise how much cash is trapped on their own balance sheets. Freeing up that cash – by optimising their working capital – delivers more than improved operational efficiency. It also gives companies the added liquidity they need to fund growth, reduce debt levels, lower costs, maximize shareholder returns and even outperform their competitors.”

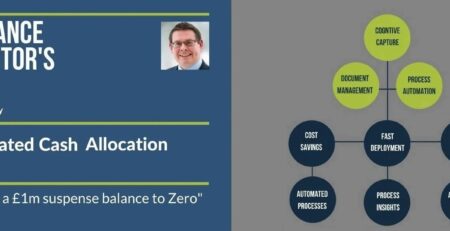

More information on our solutions for Automating Cash Allocation can be found here