Automated Cash Allocation

Achieve Same Day AI-Enabled Cash Allocation

Cost Savings with Automated Matching

Reduce your operational costs by 90% with an automated cash allocation platform

Increase Productivity with Digital Workflows

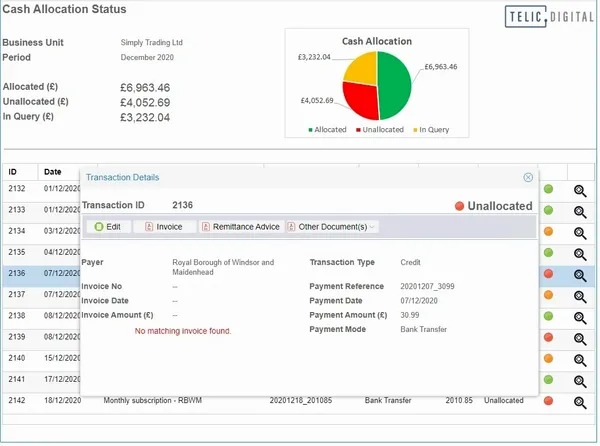

Use process automation technologies to identify and track query and exception transactions

Process Insight for Informed Decision Making

Gain visibility of critical transactions allowing your organisation to act promptly and make informed decisions

Automate Cash Allocation and Reconciliation

Automate cash allocation to achieve accurate, same-day cash posting and highlight exceptions for early resolution. The platform will automatically ingest any form of remittance, match it to received payments and automatically apply to the ledger. This not only saves significant manual data matching time but also allows the focus of teams to shift to query resolution and debt chasing for unpaid invoices.

What is Cash Allocation

Cash allocation involves the matching of incoming payments (cheque, BACS, FPS Faster Payments Service, credit card and debit card) to corresponding debtor invoices. A manual cash allocation process involves individuals in the accounts receivable team significant amounts of time attempting to match individual payment transactions to invoices.

Our platform uses leading technologies, AI (Artificial Intelligence), Machine Learning and RPA (robotic process automation), to automate the manual steps, ensure continual self-learning for increased accuracy and predictive analytics for better identification and handling of potential exceptions.

Cash Allocation Pressures

Accounts receivable teams are often under significant pressure to perform cash allocation processes. This often comes about because of peak periods or an organisation’s financial period end and is exacerbated by the multitude of ways that payments can be made, difficulties in matching poorly referenced transactions as well as part payment or payment of multiple invoices in one transaction. With teams under pressure and difficulties matching individual transactions, it can lead to human error, which only further add to future matching issues.

Reconcile Payments Automatically

Our automated cash allocation tool will allow you to streamline your process and free up team members to focus on exceptions and value-add tasks. By auto-matching payments to invoices, keeping the ledger in balance has never been simpler.

Any Remittance, Any Payment Source, Any ERP

Our platform allows ingestion of remittance data from any source, including email and email attachments, portals, and EDI (Electronic Data Interchange) and will perform automated matching with data gathered from bank accounts. Once matched, the pre-built framework for data export allows updating of ledgers into any ERP or Finance system including Oracle, SAP, Microsoft Navision, Sage, Infor and Epicor.

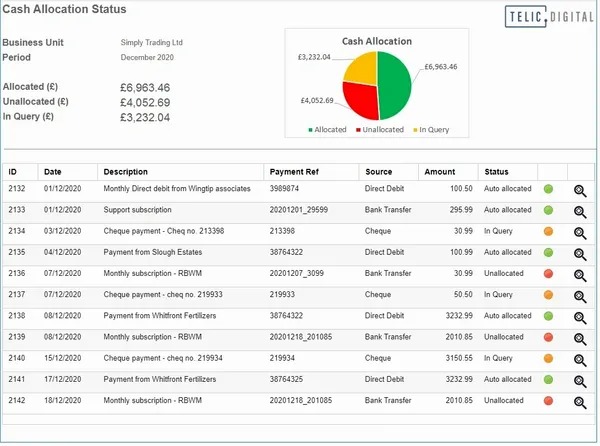

Real Time Dashboards

Granular dashboards provide insight on allocation status and visibility of all payment information in one place giving accounts receivable teams information needed to action queries and exceptions.