Automating Cash Allocation: A Finance Director’s View

As a Finance Director, I tend to be on the receiving end of many marketing campaigns with offers to discuss the benefits of intelligent process automation, but it’s not always clear what the tangible benefits are and how it could be applied to specific business processes. As someone who has implemented and used some of these technologies for automating cash allocation, what do I see those benefits to be?

- To support the evolution of the business – in this rapidly changing world that we live in it’s not always possible for our core ERP systems, and the processes around them, to keep pace with the rest of the business as new products, services and revenue models are developed. The benefits of using these technologies are that a new automated process can generally be implemented far quicker than the time it would take to make changes in the core system.

- To improve process efficiency – it seems obvious to say it, but surely doing something quicker has to be better! This efficiency can also lead to cost savings, but this is not always the case – sometimes we are just replacing one cost with another – and certainly shouldn’t always be seen as a prerequisite for a project to go ahead.

- To improve customer satisfaction – improving the speed and efficiency of a process that directly impacts the end customer, be that something as complicated as the full order to cash process or as (seemingly) simple as paying a refund request, will inevitably lead to greater customer satisfaction.

- To improve employee satisfaction – there can be nothing more sole destroying for an ambitious, bright employee than having to carry out repetitive, monotonous tasks. By automating the process they can instead be set to work on more value add tasks – not only more economical for the employer, but also far better for the development and engagement of the employee.

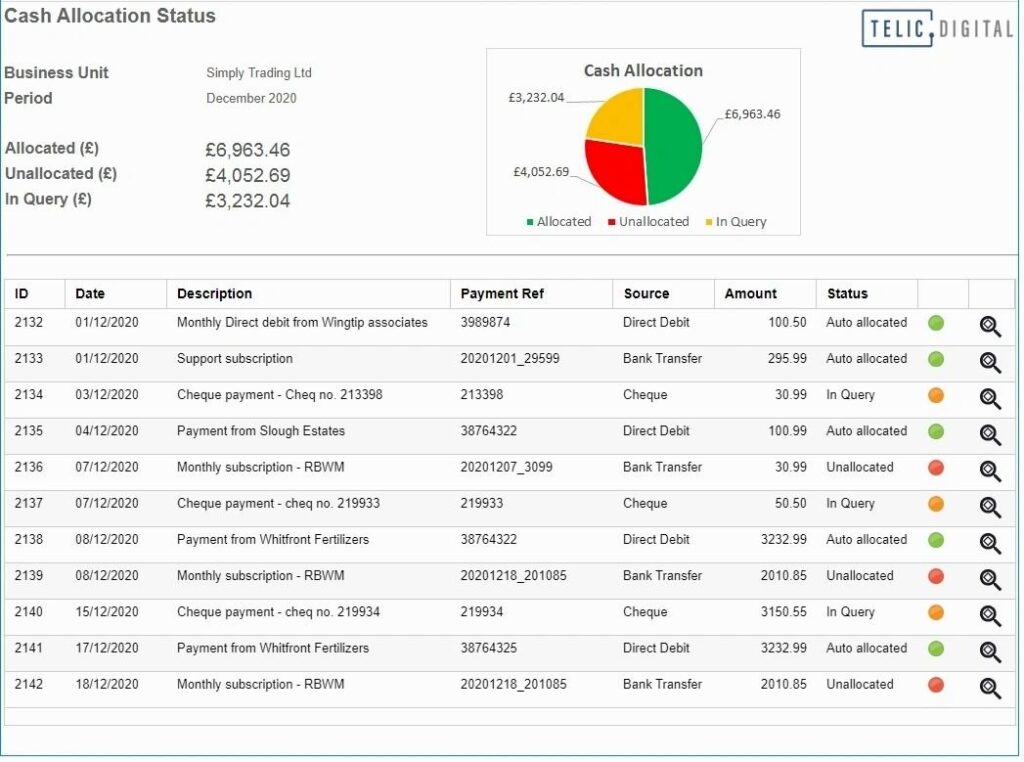

A great example of the benefits that can be achieved was a project using Intelligent Process Automation technologies to automate the process of allocating cash receipts to customer accounts. With nearly 50,000 customers and total receipts in excess of £500m, covering a number of group companies and 3rd parties where we acted as agents, cash allocation was a real headache. 6 full time employees spent their days manually allocating receipts – and where cash couldn’t be allocated it was applied to a suspense account. An average suspense balance in excess of £1m led to inefficient chasing for payments that had already been made and as a result unhappy, frustrated customers.

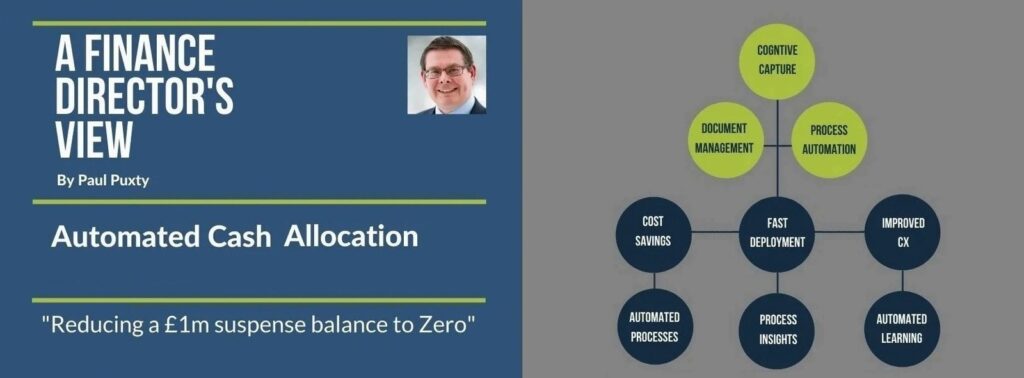

The process was automated using a Kofax Cognitive Capture Solution to scan paper and electronic (emailed) remittance advices and to allocate the amounts to the correct account. Using a combination of machine learning and artificial intelligence, very quickly the software would learn from previous allocations to improve accuracy, to the point where the balance of amounts on suspense was reduced to zero.

And the benefits of automating cash allocation:

- A far more efficient process

- Happier customers

- More engaged and fulfilled employee

This is one of many potential use cases for intelligent process automation technology and is a good example of solving a specific business issue quickly and economically without having to overhaul your ERP system. Further advice on implementing this technology can be found here.

Paul Puxty – linkedin.com