The Rise of AI in Cloud Invoice Processing: Trends to Watch in 2026

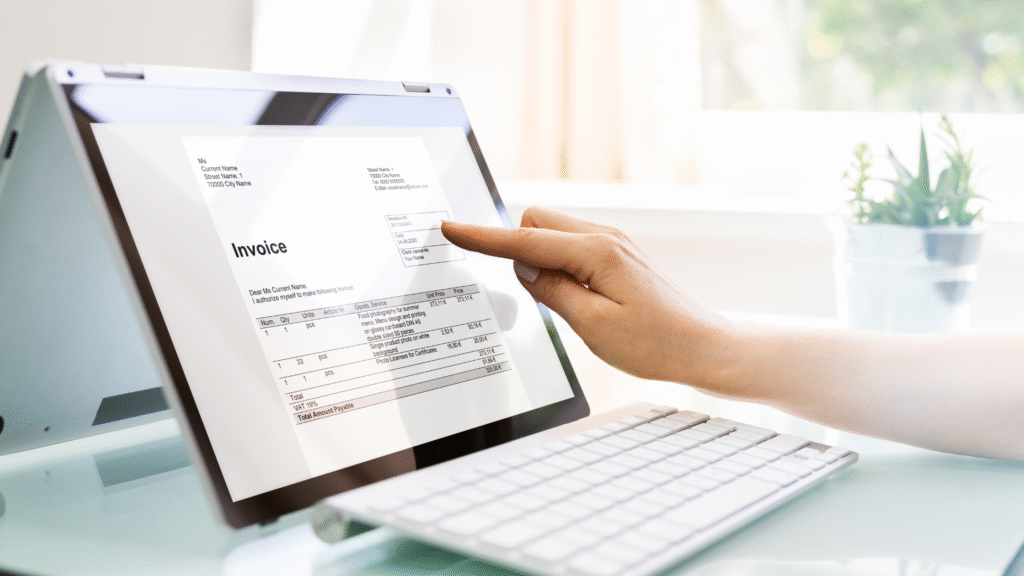

Accounts payable has changed significantly in recent years, and 2026 marks a turning point for AI-powered cloud invoice processing. As digital transformation accelerates, artificial intelligence and cloud technology are reshaping how organisations manage invoice workflows.

At Telic Digital, we have seen how AI-driven cloud invoice processing helps finance teams move beyond manual data entry and legacy systems. As we move through 2026, several important trends are shaping the future of invoice processing automation.

1. Hyper Intelligent Data Extraction with Self Learning AI

In 2026, AI models not only extract data but also understand context, learn from corrections, and continuously improve accuracy.

Today’s cloud invoice processing platforms use advanced machine learning to handle invoices from any supplier and in any format. Unlike older template-based systems that required extensive setup for each vendor, modern AI can automatically recognise invoice layouts and accurately extract header and line-item data.

This shift is especially important for organisations with diverse suppliers. Template-based extraction was the original approach, requiring pre-configured formats for each vendor. Later, technology shifted to OCR-based keyword detection, which scanned pages for phrases like “Inv Number” and extracted nearby text. Now, AI is trained to recognise what an invoice looks like and read documents much like a person, leading to greater accuracy. Telic’s AI-Powered Cloud Invoice Processing uses advanced AI and machine learning to automatically ingest, recognise, and verify invoice data, achieving top extraction rates. The platform also learns from every correction, so its accuracy improves over time without extra work.

2. Seamless Multi Source Invoice Ingestion

In 2026, invoice entry has become more sophisticated. Organisations no longer require separate workflows for email, supplier portals, or EDI feeds. AI-powered cloud platforms now capture invoices from any source and route them through a unified processing pipeline.

This capability addresses a key challenge for AP teams who previously managed multiple systems. Regardless of how invoices arrive, AI ensures they are captured, classified, and processed consistently.

The productivity gains are significant. Finance teams report that automating invoice capture saves hours each week and greatly reduces the risk of missed or delayed invoices.

3. Intelligent Matching and Validation

A key application of AI in 2026 is three way matching. Traditional systems required exact matches between purchase orders, goods receipts, and invoices, often flagging legitimate transactions as exceptions.

Current AI systems use fuzzy matching algorithms to identify legitimate matches, even with minor discrepancies in descriptions, quantities, or pricing. The technology distinguishes between exceptions needing human review and harmless variations that can be automatically approved.

Cloud invoice processing now integrates with ERP systems to retrieve purchase order data, match it intelligently, and verify invoices against business rules. This automatic checking finds errors before they reach accounting, helping organisations avoid duplicate payments, pricing mistakes, and fraud.

4. Pre-Built Integration Frameworks

Integration has historically been a major barrier to AP automation. Many organisations strived to benefit from automation but were discouraged by complex, costly integration projects.

In 2026, this barrier has largely been removed. Cloud invoice processing platforms now offer pre-built connectors for major ERP systems, including Microsoft Dynamics 365, Oracle NetSuite, Oracle Fusion Cloud, SAP, Coupa, Sage, Infor, QuickBooks, and Xero.

These frameworks manage each system’s data structures, validation requirements, and workflow triggers. As a result, implementation time and costs are significantly reduced. Organisations can move from evaluation to full production in weeks, achieving rapid return on investment.

5. Real-Time Visibility and Process Intelligence

AI has transformed dashboards from static reports into dynamic command centres for AP operations. In 2026, finance leaders expect real time visibility into every aspect of invoice processing.

Modern cloud platforms give detailed insights into invoice status, processing slowdowns, approval steps, and how exceptions are handled. AI-powered analytics show patterns in supplier behaviour, payment trends, and processing efficiency, helping finance teams make better decisions based on data.

This visibility also improves exception management. Teams can track every exception, understand its cause, and monitor resolution progress. Automation technologies identify and track queries, ensuring nothing is overlooked.

6. Enhanced Support for Remote and Hybrid Work

The move to remote and hybrid work has made cloud-based AP automation essential. In 2026, this trend is growing as organisations see that being able to process invoices from anywhere is a real competitive advantage.

Cloud invoice processing removes the need for physical invoices and enables seamless approval workflows across distributed teams. Approvers can review and approve invoices from any location or device, maintaining business continuity.

This flexibility is especially valuable for organisations with multiple locations or fully remote finance operations. The cloud model ensures that all team members have access to the same platform, data, and functionality, without requiring complex VPNs or raising security concerns.

7. Democratised Access Through Cloud Economics

A big trend in 2026 is how cloud pricing has made enterprise-level invoice processing automation available to more businesses. Small and medium-sized companies that couldn’t afford on-premises systems can now use AI-powered tools with flexible subscriptions.

Cloud-based solutions eliminate the need for large upfront investments in infrastructure and licenses. Organisations can choose service levels that fit their needs and pay only for what they use. Many providers offer trial periods so businesses can try the technology before deciding.

This easy entry lets more organisations eliminate manual invoice processing, cut costs, and access cash-flow benefits that were once reserved for large companies.

8. Continuous Learning and Adaptive Correction

A key development in 2026 is how AI systems learn from user interactions. When AP staff correct extraction errors or adjusts validation rules, the system retains and applies this knowledge to future invoices.

This creates a continuous improvement cycle. As more invoices are processed, the system becomes smarter. Organisations report that extraction accuracy rates, already high at deployment, continue to improve as AI learns their specific patterns and business rules.

The impact extends to approval routing, exception handling, and fraud detection. AI systems learn to recognise patterns indicating duplicate invoices, pricing anomalies, or suspicious supplier behaviour, flagging issues before improper payments occur.

The Path Forward: Making the Transition with AI in Cloud Invoice Processing

As we look at the remainder of 2026 and beyond, the question for most organisations isn’t whether to adopt AI-powered cloud invoice processing, but how to make the transition as smooth and successful as possible.

Modern platforms have simplified this process. Organisations can evaluate cloud invoice processing through demonstrations tailored to their processes and invoice types. Many providers, including Telic Digital, offer to test actual customer invoices to demonstrate extraction accuracy and integration capabilities using pre built connectors.

This try-before-you-buy approach removes much of the risk and uncertainty from the decision-making process. Finance leaders can see concrete evidence of how automation will affect their operations before committing.

Delivering Value Across Every Dimension

AI-powered cloud invoice processing delivers transformative benefits across AP operations. Organisations report significant productivity gains as digital workflows replace manual data entry, allowing AP teams to focus on exception handling, supplier relationships, and other value-added activities.

Cost savings result from reduced labour, elimination of late payment penalties, and improved capture of early payment discounts. Real-time dashboards enable faster decision-making and better cash flow management.

Perhaps most importantly, AP teams report improved job satisfaction. Freeing team members from tedious manual data entry allows them to focus on more meaningful work, applying their expertise to complex exceptions and strategic initiatives rather than on repetitive tasks.

The Path Forward: AI in Cloud Invoice Processing

The rise of AI in cloud invoice processing is more than just a tech upgrade; it’s a complete rethink of how finance works. As 2026 progresses, we expect to see even more advanced AI use cases, such as predictive cash flow analytics, automated vendor management, and smart routing based on payment terms and business needs.

For organisations still using manual invoice processing or legacy systems, the gap is widening. The competitive advantages of AI-powered cloud solutions, including superior accuracy, lower costs, greater flexibility, and continuous improvement, make adoption increasingly urgent.

The future of invoice processing is intelligent, cloud-based, and continuously learning. Organisations that embrace this future will achieve not only operational efficiency but also strategic agility in a competitive business environment.

To experience the benefits of AI-driven cloud invoice processing, explore Telic’s solution and see how our platform can transform your accounts payable operations. With flexible pricing, free trials, and expert support, now is an ideal time to transition to intelligent automation.