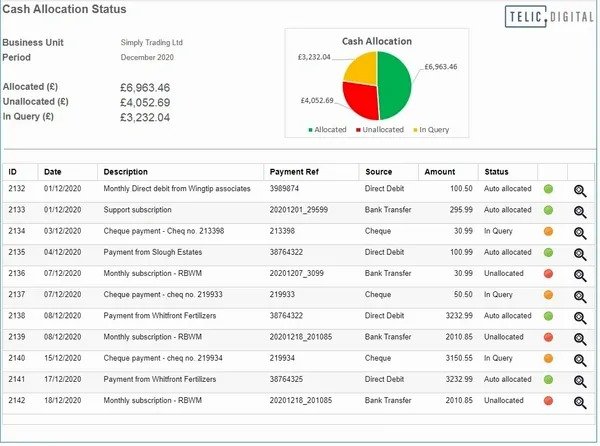

Automated Cash Application simplifies the process of matching incoming payments whether from cheques, BACS, Faster Payments, or card transactions to the correct customer invoices.

Traditionally, cash application can be a time consuming, manual task for accounts receivable teams, requiring significant effort to align individual payment transactions with their corresponding invoices.

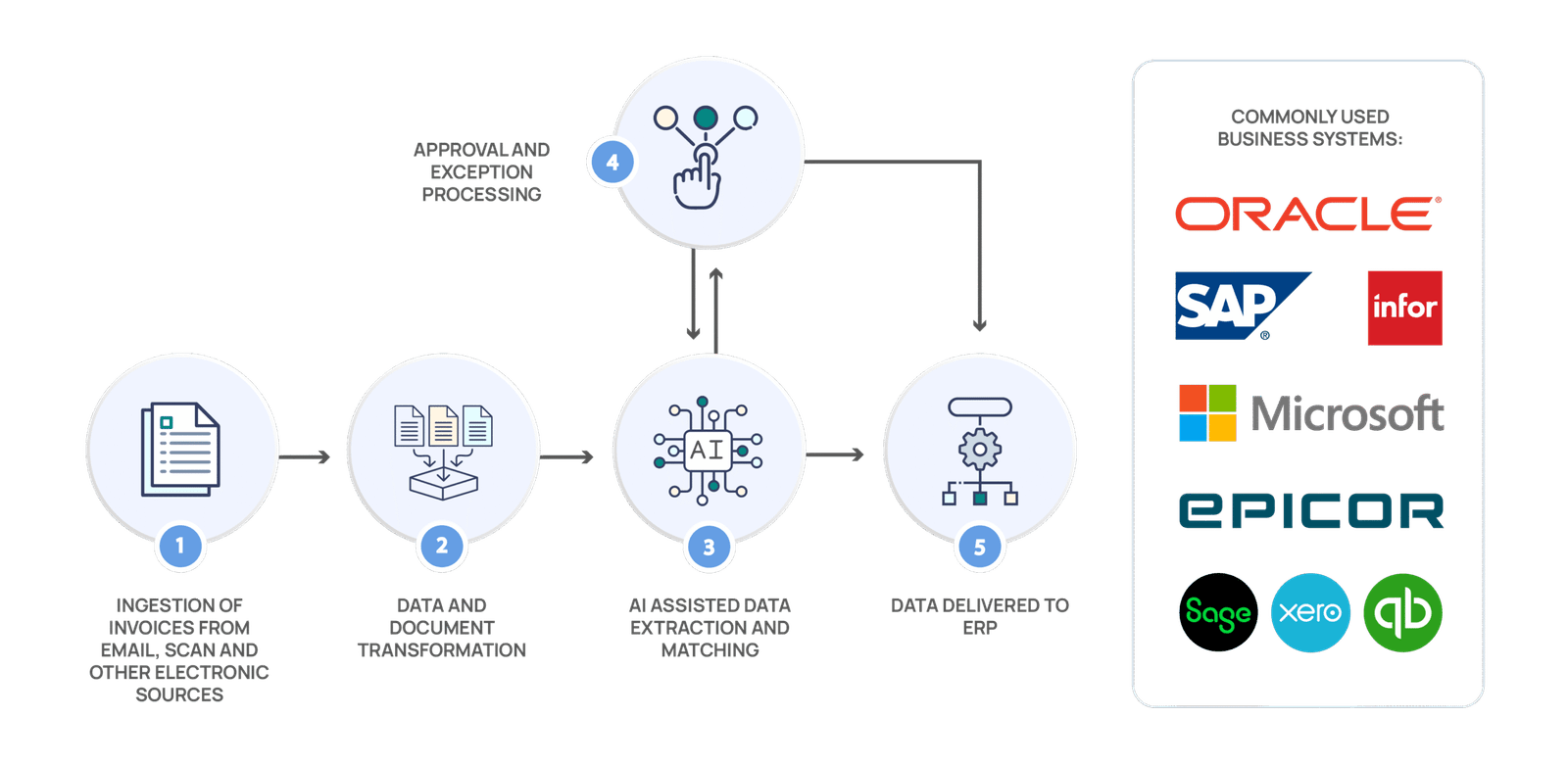

Our platform uses industry leading technologies like Artificial Intelligence (AI), Machine Learning, and Robotic Process Automation (RPA), to automate those repetitive steps, making the process faster and more accurate. As the system learns over time, it gets better at matching payments, and with built in predictive analytics, it can flag and help resolve potential issues before they escalate.

By automating cash application, businesses can reduce errors, improve cash flow visibility, and free up valuable resources for higher value tasks, leading to efficiency and improvement in customer satisfaction.

To discover how you can automate your cash application process, book a demo to see the platform at work

Reduce manual efforts and cut operational costs by up to 90% with an intelligent cash application platform that automates payment matching and reconciliation.

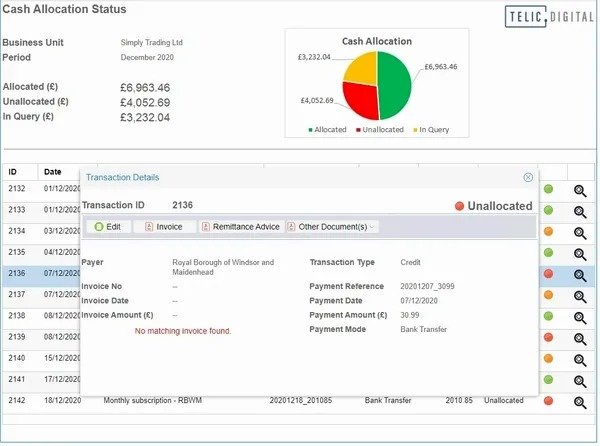

Process automation identifies, tracks, and resolves exceptions in real-time, reducing delays and minimising manual interference in cash application.

Achieve full visibility into cash inflows and critical transactions, allowing your organisation to act promptly, optimise working capital, and improve financial forecasting.

With automated cash application, payments are posted accurately on the same day, while any exceptions are flagged for a quick solution. The system automatically captures remittance data, matches it to the right payments, and applies everything to the record. This means your team can spend less time on manual matching and more time resolving queries and chasing outstanding payments, helping to improve cash flow and efficiency.

Accounts receivable teams face constant pressure to keep up with cash application, especially during peak periods or financial month-end. The complexity of processing payments from multiple sources, whether it’s through bank transfers, card payments, or cheques, it gets harder to match transactions accurately. Poorly referenced payments, partial payments, and lump-sum payments covering multiple invoices add another layer of difficulty. When teams are under pressure, errors become more likely, leading to more reconciliation issues down the line. Without the right tools, cash application can quickly become a frustrating and time-consuming process.

Our platform captures remittance data from any source—whether it’s email attachments, customer portals, or EDI (Electronic Data Interchange)—and automatically matches it with payment data from bank accounts. Once payments are accurately applied, the system automatically updates your record, integrating with leading ERP and finance systems like Oracle, SAP, Microsoft Dynamics, Sage, Infor, and Epicor.

With automated cash application, payments are applied accurately and instantly, so your team spends less time on data entry and more time on other priorities resolving exceptions and focusing on higher value tasks. Keeping your record balanced has never been this easy.